Psychologists Applying for Blue Cross Blue Shield Insurance Panels

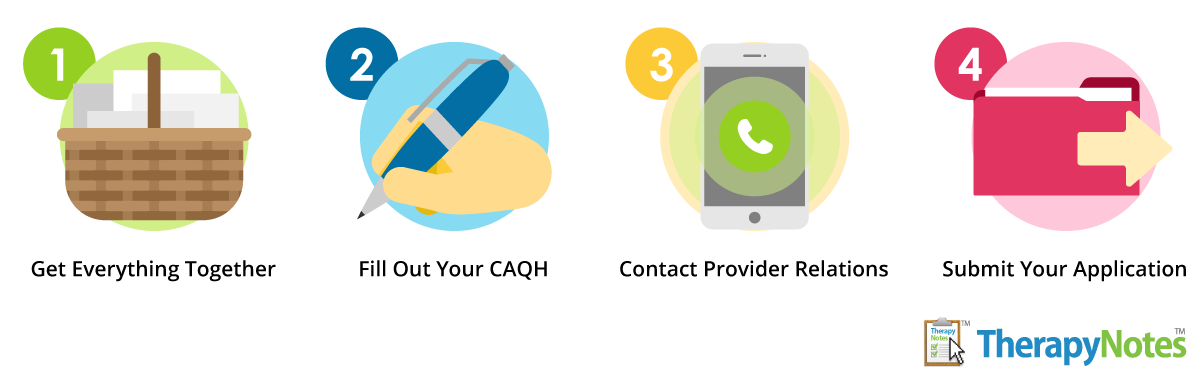

From lost applications to being on hold for hours, it's no wonder so many therapists only accept direct pay clients. Even without those challenges, it can take up to 4 months to get paneled. Let us help you get started. Here's a step-by-step guide on how to get on insurance panels. (Find out here how we can help you get credentialed!) Getting paneled requires a lot of information and documentation, which may include your: Many companies use the Council for Affordable Quality Healthcare (for credentialing. But make sure you're ready before starting the process. That means your resume needs to be perfect, with dates formatted as MM/YYYY and no gaps in employment. Also, make sure you complete your application through the enrollment hub atCAQH.organd not by paper. The paper application is dozens of pages long, only prints correctly in color, and will need to be entered into the system by clerical staff anyway (if they ever get around to doing so). After applying, make sure you don't lose any of your application information, since you'll be asked to "re-attest" to it 2–4 times per year. Make sure to respond to such requests quickly. Insurance companies will know if you don't and may refuse to pay claims. The next step is to choose which insurance panels you want to be on. These companies can vary widely in their reimbursement rates, provider-friendliness, and payment speeds and restrictions. Some companies may even require several years of post-licensure experience just to apply. Make sure to ask your network for recommendations and tips. Once you're ready, contact each insurance company's provider relations department for an application. The best thing you can do when an insurance company tells you they're full or not accepting applications from people with your specialty is build a relationship with the provider until they have openings for your preferred services. This means calling them to reiterate your differentiating skills. You could also expand your services and let them know you've done so. Some examples may include: If this doesn't work, check back quarterly, since their capacity may change. Between filling out your application, making follow-up calls, and getting contracted, the entire application process may take about 10 hours per panel. After applying, you'll need to follow up regularly. If your application gets stuck in limbo with no action for too long, it may expire and you'll have to start all over. To avoid any issues, make sure to call the insurance company every time you submit documentation to make sure they received it. Also, keep copies of everything you submit, since it's not uncommon for files to get lost, shredded or deleted. Before doing a celebratory dance, make sure once you're approved that you: Once you've done this,TherapyNotes™ can help you submit your insurance claims electronically. This will save you time and paper, speed up payments, and reduce the likelihood of errors on claims. But remember: Insurance companies are there to manage healthcare costs. So, you'll need to demonstrate why you can help them keep costs low. This will take time and resources, like applying for a job, but it's well worth it. Good luck! Tell us what panels you're interested in, and we'll take care of the rest. Learn more about the easy, 5-step process that can save you time and effort and help you avoid mistakes.

Step 1: Get everything together

Step 2: Fill out your CAQH

Step 3: Contact provider relations

What to do if they're full

Step 4: Submit your

What to do when you're approved

Let Us Help You Get Paneled.

* The content of this post is intended to serve as general advice and information. It is not to be taken as legal advice and may not account for all rules and regulations in every jurisdiction. For legal advice, please contact an attorney.

Get more content like this, delivered right to your inbox. Subscribe to our newsletter.

Source: https://blog.therapynotes.com/getting-on-insurance-panels-how-to-navigate-the-process

0 Response to "Psychologists Applying for Blue Cross Blue Shield Insurance Panels"

Post a Comment